Furthermore, we are seeing a reassessment of policies which is sending confusing signals to industry and slowing the transition to a greener economy, such as delaying the phasing out of gas boilers or shelving innovative green investment plans.

As the cost of business and living rises, politicians are looking for different ways to show commitment to net zero in the long term whilst delaying short term actions. All of this is against a backdrop of the warmest September globally on record and deeply concerning news that the world breached the 1.5 degrees temperature rise for more than a third of 2023 1.

A survey by Harvard Business Review showed 56% of European companies view ESG issues as opportunities. This compares to 30% of US based companies 2. On the other hand, 34% of US companies perceive ESG issues as a risk factor compared to 13% of European companies. This highlights a growing chasm between the US and Continental Europe on green growth policies.

Whereas ESG feels like it’s lost its way in the political sphere, real estate investment in sustainability remains focused on addressing the climate emergency. This is evidenced by companies with more than $400 billion in AuM becoming signatories to the Better Building Partnership’s Climate Commitment 3. At Savills IM we recognise the short-term trade-offs and the difficult decisions the governments around the world are having to make, but we are not letting it influence our own commitment to ensuring that the assets we manage do not become obsolete.

This ambition stems from our belief that a company that puts sustainable investing at the heart of its business plan will be best placed to deliver robust long-term returns to investors. This is evidenced by the increasing focus on impact investment, with the Global Impact Investment Network estimating that $1.164 trillion is currently invested into impact products 4. That said, global real estate is worth c. $379 trillion, with less than 1% of that value invested currently into impact products 5. So can real estate catch up? Even if impact outcomes seem harder to achieve, it is abundantly clear that energy efficiency initiatives like insulation of homes, smart metering, or investing in making buildings climate resilient have clear economic advantages in the short and long term, regardless of policy shifts – lower energy bills being one of the most pronounced.

In addition, ensuring that wider sustainability considerations like good indoor air quality, focusing on biophilic design and access to quality green spaces, installing onsite renewables and embracing circular economy principles all help to position the asset as a quality building, which can support investor returns. As a company we are investing in upskilling our own people on sustainable investing outcomes through increasing resources, providing training on net zero implementation, integrating sustainable investment outcomes into variable employee remuneration, sponsoring system change programmes such as ULI’s C Change 6, co-chairing BBP’s Owner Occupier Forum 7 and inputting into the INREV ESG Committee 8. Can we afford to waver like politicians have been accused of doing? The simple answer is no, we need to keep our long-term targets in mind. But we need to be aware of practical implications when money is so tight for so many. We must keep focused on measures that can save occupiers money whilst improving buildings’ sustainability credentials. We are also upskilling our sector to have the skills needed to make buildings become sustainable in the widest sense, which inevitably will, despite the policy changes, lead us to prioritise adapting buildings to be resilient to the worst physical impacts of climate change and a net zero outcome.

Finally, we believe firmly that this challenge is a shared responsibility for all participants in our sector. Just as we should all eschew “greenwashing”, we should also not engage in “competitive greenification” with other investors in the sector. We are committed to sharing best practice and ensuring that problems are not just passed onto others or abandoned by selling brown assets or only acquiring green ones. Timing, however, is vital. We cannot expect best-in-class ESG expenditure to top the priority list during a cost of living crisis. But essential improvements that can improve cashflow and remove risk, such as improved energy efficiency, will understandably take priority.

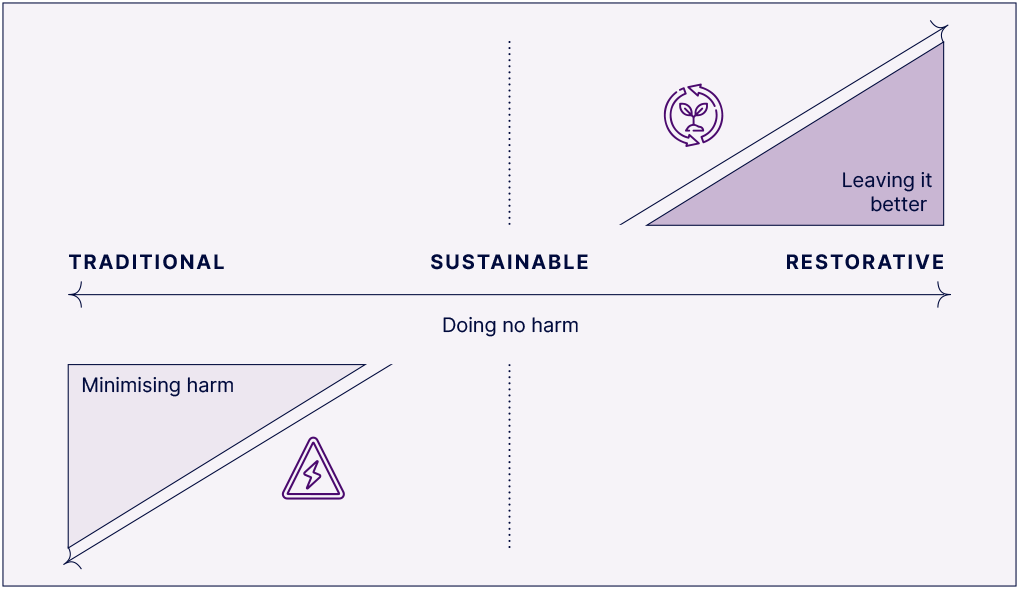

Figure 4: The journey to a restorative future

Sources: Graphic adapted from Futuremakers, 2022; Ethan Rowland Solovieb, 2018.

1 BBC by Matt McGrath, Mark Poynting, Becky Dale & Jana Tauschinskii, “World breaches key 1.5C warming mark for record number of days”, 7th Oct 2023, https://www.bbc.com/news/science-environment-66857354, accessed on 26th Oct 2023

2 27th July 2023, Harvard Law School Forum on Corporate, Posted by Julie Daum (Spencer Stuart) and Kira Ciccarelli (Diligent Institute), on Thursday, July 27, 2023, “Sustainability in the Spotlight: Has ESG Lost Momentum in the Boardroom?”, Governance , 27th July 2023 https://corpgov.law.harvard.edu/2023/07/27/sustainability-in-the-spotlight-has-esg-lost-momentum-in-the-boardroom/, accessed on 26th Oct 2023

3 https://www.betterbuildingspartnership.co.uk/, accessed on 26th Oct 2023

4 Global Impact Investing Network (GIIN), “Global Impact Investing Network (GIIN) estimates worldwide Impact Investing Size to be USD $1.164 Trillion in an industrial Milestone”, 12th Oct 2022, https://thegiin.org/assets/GIIN.Release.Market Size_.pdf, accessed on 26th Oct 2023

5 Savills UK, “Total global value of real estate estimated at $379.7 trillion – almost four times the value of global GDP”, 25th Sept 2023, https://www.savills.co.uk/insight-and-opinion/savills-news/352068-0, accessed on 26th Oct 2023

6 ULI Europe, C Change programme, https://europe.uli.org/research/c-change/, accessed on 26th Oct 2023

7 Better Building Partnership, Owner & Occupier Forum https://www.betterbuildingspartnership.co.uk/our-priorities/owner-occupier-forum, accessed on 26th Oct 2023

8 INREV ESG Committee, https://www.inrev.org/committees/ESG, accessed on 26th Oct 2023

A MESSAGE TO REAL ESTATE: CUT ENERGY CONSUMPTION AND PRIORITISE RETROFITTING

While climate change deniers point to spurious claims from spurious experts about its impact, scientists have warned us that “catastrophic” damages to our societies are feasible this century from warming levels that we have already passed. The bizarre weather events of 2023 should be a wake-up call to anyone who thinks that business as usual can continue.

The most important thing that we can do to minimise the dangers we face is to drastically reduce our consumption of energy. The real estate industry can do much to help here, by replacing construction by retrofitting to reduce the energy wastage that currently abounds in our retail and commercial real estate. Every double-glazed window, every passive heat and rain management system you can install reduces the demand for energy, which is far and away the main contributor to our overshooting of the planet’s capacity to support our industrial civilisation.

We are energy-blind, and yet when unbearable heat, persistent drought and sudden catatonic downpours strike, we’ll suddenly realise that what we take for granted—these salad days of cheap and abundant energy—are over. Any energy we can put now into making our buildings far more efficient will reduce the damage that global warming will do, not merely to our children’s futures, but to our own immediate futures. Just reducing energy is not enough. We need to restore the planet to the biodiverse and bio- abundant world it once was. We need bold, systemic change, and investment into nature-based solutions the scale of which may previously have been unthinkable but now is essential. If humans have proved one thing, we are nothing if not innovative.

STEVE KEEN

Dr Steve Keen is a researcher at the Budapest Centre for Long Term Sustainability. He is a Distinguished Research Fellow at UCL, and a crowdfunded commentator on Substack and Patreon.