“Are we there yet?!” The unequivocal sound of weariness and despair that emanates from the back seat during a long car journey. Which also feels fitting in the context of the fight against inflation, rising interest rates and the correction in real estate pricing. With the inflation dragon looking to have been slayed following the fastest interest rate hiking cycle by Western central banks over the past 30 years, it certainly seems as though we are there when it comes to the top of the interest rate cycle. Although, events in the Middle East potentially muddy the outlook.

However, with the impact from higher interest rates now hitting economic activity, real estate isn’t quite there just as interest rates stay higher for longer. Occupational markets have held up well. But as the cyclical downturn hits tenant demand, pressures on rents are a near-term downside risk for valuations.

The relative attractiveness of fixed income remains a challenge for real estate capital raising, while further pockets of distress will likely flare up – more than €100 billion of real estate loans across Europe are due for refinancing in 2024 at significantly higher interest rates 1. While that might sound all a bit gloomy, it becomes an opportunity for new real estate lending and as veterans of the real estate world will know, previous downturns have been followed by cyclical upturns and periods of strong performance.

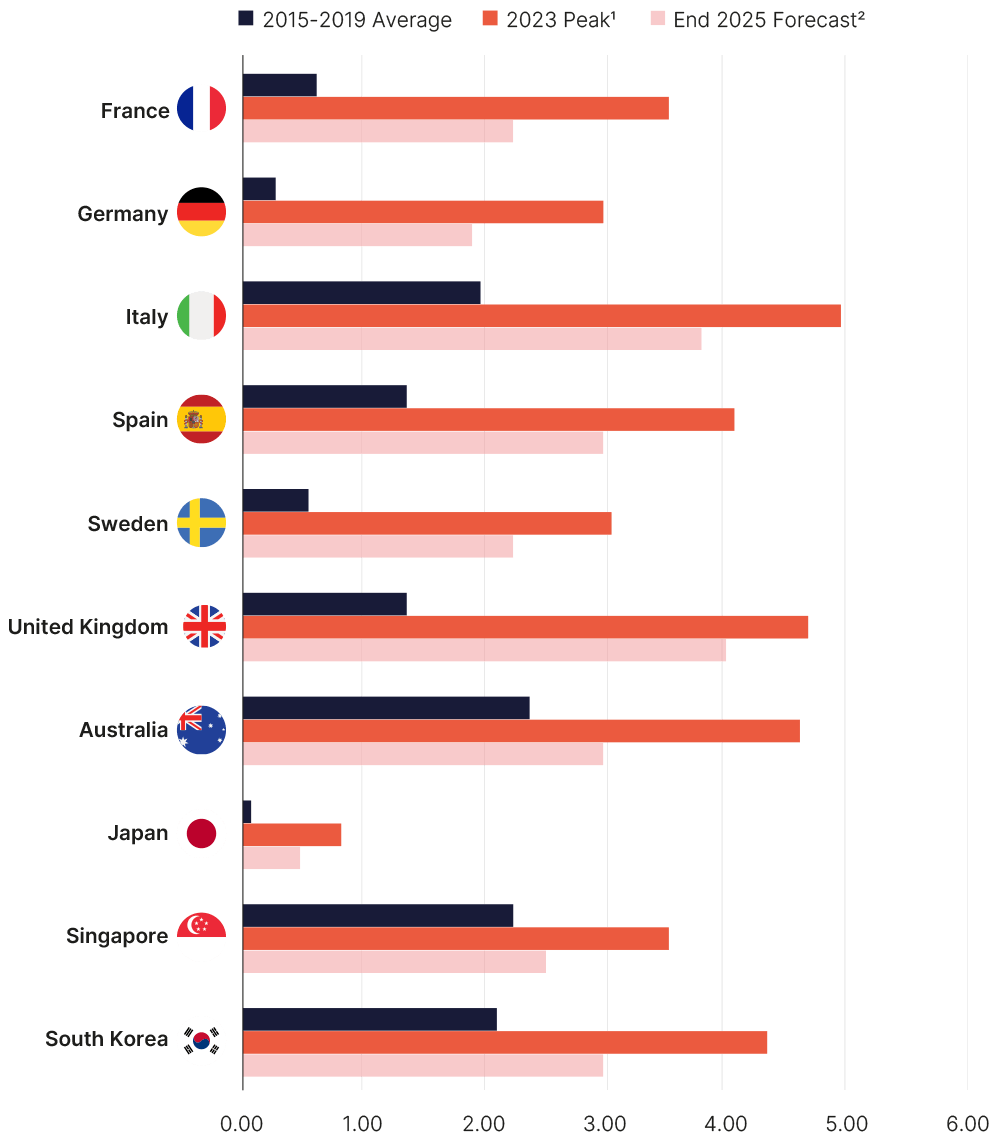

As the outlook for interest rates becomes clearer and borrowing costs start to fall in 2024 (if forecasts are correct), this should start to loosen the shackles around real estate. Exactly how far and how fast rates fall will depend on country-specific dynamics. With the exception of Japan, 10-year government bonds are expected to be 70-to-170bps lower by end-2025 than their 2023 peaks 2 in the main Asia-Pacific and European markets. But that would still leave them around 30-90bps higher in APAC and 160-270 bps higher in Europe than what we saw between 2015 and 2019. 3(Figure 1)

In a world characterised by a reset in interest rates, investors need to think and act differently, focusing more on the income side and rental growth generation to hit hurdle rates and outperform. This will require a more sophisticated approach to allocation and asset management plans. That is not to say yields won’t start to move in again. But the days of buying an asset, sitting back and letting yield compression do all the heavy lifting are likely to be consigned to history, at least in the early phase of the next cycle.

“Previous downturns have been followed by cyclical upturns and periods of strong performance. “

Focusing on sectors where long-term demand drivers and supply constraints support rental growth is a good place to start. For these reasons we are positive on the urban industrial and logistics and Living sectors. We also remain supportive of grocery-orientated and discount and convenience retail, which have shown their structural resilience through the pandemic and cost-of-living crisis. That doesn’t make other sectors “no-go” areas. But investors will need to be much more selective in their approach, particularly when it comes to offices.

Sustainability and the road to net zero are issues that investors will need to pay greater attention to. Ignoring these issues increases leasing risks and the acceleration of functionally obsolete and stranded assets.

As sure as the day follows the night, the clouds hanging over real estate will lift. Mispricing opportunities will present themselves for those willing to take the plunge. By focusing on sectors and assets where structural changes support income generation and income security, investors will be well positioned to take advantage of the next cyclical upturn.

Figure 1: 10-year government bond yields (%)

Sources: Macrobond, Oxford Economics, Savills IM (Oct. 2023)

Notes: 1As at 8 October 2023, 2Oxford Economics

1 Savills IM calculations based on Bayes Business School data as at end-2022

2 Macrobond (8 Oct. 2023)

3 Savills IM calculations based on Oxford Economics forecasts & Macrobond data (8 Oct. 2023)