Structurally we are entering a new period for offices. While many people focus on office occupancy and regional difference in terms of employees returning to the office, the future of the office debate is a much more complex question, driven by longer-term structural changes. As a result, this should alter how investor’s view and allocate to the sector.

Focusing on the European office market, we believe there are three key factors which are altering the nature of tenant demand and ultimately investor returns:

- Structurally weaker occupier demand;

- increasing lease flexibility; and

- energy efficiency and sustainability demands.

We believe these trends are also impacting other office markets around the world, albeit with regional and market variations. And these will eventually widen the performance gap between high quality and average assets.

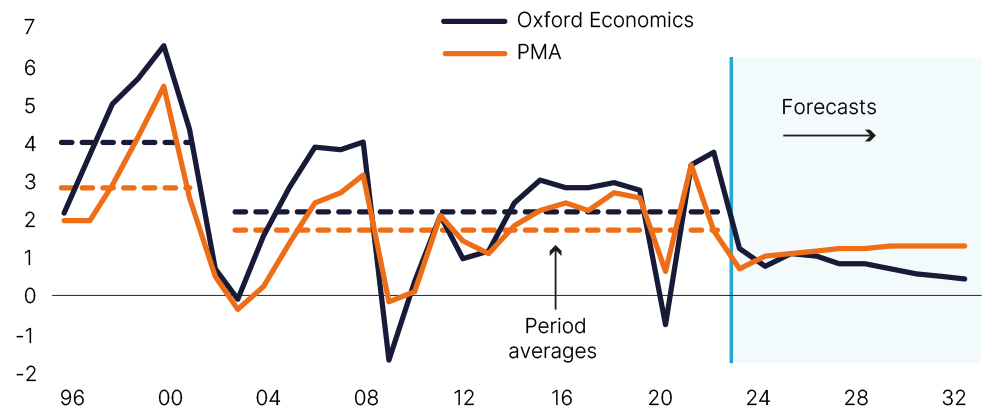

Technology has long been a driver of improving productivity, allowing firms to reduce the total amount of space they require per worker. Until now, this has been offset by favourable demographics and a shift towards more service-based economies, which have supported overall office demand. But what were tailwinds are turning into headwinds; weaker employment growth over the coming years as working populations decline implies lower occupier demand (see Figure 9).

As firms increasingly see the office as representative of their brand image, and compete to attract and retain talent, data from Savills Research suggests that tenants are placing greater emphasis on better quality, more operationally efficient, flexible and sustainable space. The flight to quality and amenity, including accessibility, convenience and lifestyle factors, has emerged as dominant market dynamic, increasing the importance of location, location, location. This increases the leasing and obsolescence risks of mediocre space, particularly in fringe locations, which are at greatest risk of a significant correction in pricing.

The flight to quality and amenity, including convenience and lifestyle factors, has emerged as dominant market dynamic.

At the same time, evidence from the UK shows a push towards greater lease flexibility – shorter leases and increased use of break clauses. This reduces the security of income streams and increases void risks. In the London City office market for example, where a lease includes a break, there is a 50:50 chance that it will be exercised.

Stricter Energy Performance (EPC) regulations, together with increased tenant demand for higher quality, more sustainable buildings, mean landlords need to improve their assets. Although this might be seen as a necessary one-off cost, as the overall quality and sustainability of office stock is improved, this is likely to require higher ongoing costs than in the past. In APAC, for example, capital expenditure as a percentage of operating income doubled from approximately 10% to 20% between 2010-20 according to MSCI data.

That is not to say there aren’t opportunities. As tenant demand coalesces around higher quality, well-located, sustainable buildings, investors options are to acquire or create the best assets in the best locations. A near-term supply squeeze on grade-A stock is expected to drive rental growth for better quality stock. This also provides scope for ‘brown-to-green’ strategies, although the investment opportunity here is likely to be smaller than most expect. Similarly, office to residential conversion is a widely talked about strategy, although this is much easier said than done as Steven Paynter of Gensler explains.

The upshot is that the office sector entails greater risk and is more operationally intensive and specialised than most investors appreciate. Pricing has yet to fully adjust to reflect this.

Fundamental changes in occupier requirements mean office markets are increasingly oversupplied with stock that lack the attributes that make them attractive for occupiers and good, long-term, future-proofed investments. As a result, investors need to carefully consider the relative merits of offices in terms of risk-return profiles and allocations.

Figure 9: Office-based employment (% p.a.)

Source: Oxford Economics, PMA, Savills IM (20 April 2023)

OFFICE TO RESIDENTIAL CONVERSIONS: MANDATES, MYTHS, AND POSSIBILITIES

Today, both cities and commercial real estate investors are facing a lot of headwinds. Headline grabbing office vacancy rates began pre-2020 and the onset of the pandemic, but the ‘flight to quality’ has been quietly impacting Class B & C buildings for years. Shifting working patterns and the rise of hybrid is accelerating this trend. The result, dubbed the ‘urban doom loop’, which characterises a hollowing out of city centres, invites speculation over who should worry more: investors or city mayors. An emerging solution is one my firm Gensler has explored in depth, converting those vacant offices into housing. This solution seems like a no-brainer. But is it really that simple?

The interest in this subject has reached fever pitch in the past 12 months, with cities announcing or exploring incentive programmes. Developers are taking note. Gensler notes that conversion project evaluations skyrocketed from about 100 in 2021 to over 900 in the latter half of 2023.

But not every vacant office can be converted into housing. Unavoidable structural difficulties and the need for financial feasibility make conversions viable in specific scenarios. In fact, Gensler’s analysis of nearly 1,000 buildings globally indicates that only 25 percent of existing Class C office buildings make the cut for conversion. That said, converting just 5 percent of these offices could still yield more than six million new homes and the potential to create vibrant, 24/7 downtown neighbourhoods. Gensler’s approach creates the opportunity to assess in minutes whether stranded assets are suitable for conversion, and what the potential change of use could look like.

Office-to-residential conversions aren’t a silver bullet for many older, low-quality office buildings. But they can be a part of the solution. Projects like 160 Water Street in New York highlight that once a good building has been identified, the results can be transformational.

STEVEN PAYNTER

Steven Paynter is Principal, Global Practice Area Leader: Building Transformation + Adaptive Reuse, Gensler – a global architecture, design, and planning firm with 53 locations and 6,000+ professionals across the world.

Source: Gensler (October 2023)