There are probably no records that the industrial and logistics sector has not broken in recent years. Record take-up in the lettings market, almost full occupancy, rental growth, and capital value growth rates in double digits in some cases – and that is per year! Even the pandemic proved to be a positive boost and demand driver, highlighting logistics as a system-relevant infrastructure.

The legitimate question now is: are we past peak performance and what happens as we go into 2024?

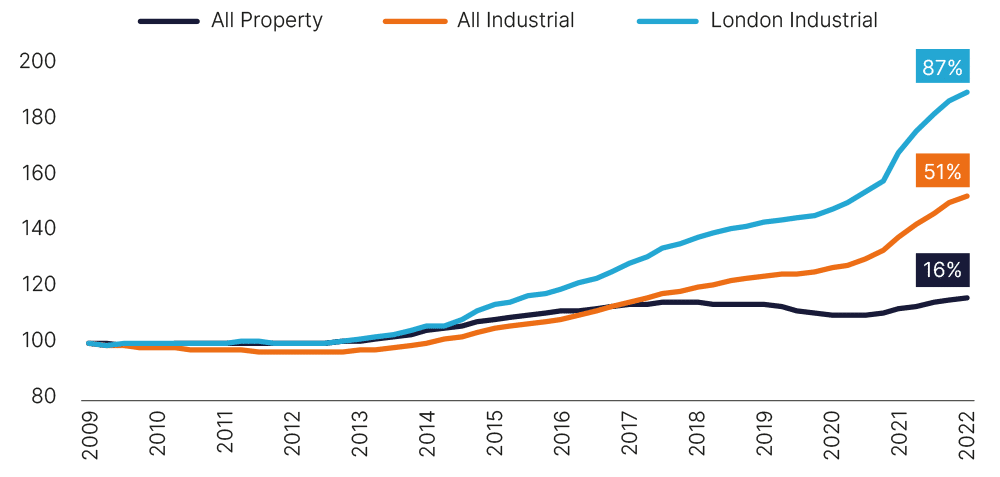

Whilst the sector cannot be immune to the economic downturn, and capital values have fallen due to the turnaround in interest rates, it is worth taking a quick look back. Industrial and logistics returns in the last decade were driven by yield compression from two directions. Firstly, capital values increased due to declining and ultralow interest rates and secondly by the institutionalisation of the industrial and logistics sector. It has developed as a highly liquid asset class with strong occupier market fundamentals and clear investment criteria.

Considering the changed interest rate landscape, the factors driving future industrial and logistics returns are transitioning from yield tightening to rent growth; and real rental growth predictions are sound. The excess occupier demand is structural for the core industrial and logistics locations, and rents will continue to rise for three key reasons:

- Vacancies are low, and new supply constrained by high finance and development costs.

- The existing quality of stock is often poor, being outdated for operational and energy performance requirements. By example, in Japan, only 10% of existing industrial facilities in the greater Tokyo area were constructed after the year 2000 1. We see it as implicit that older format facilities are inefficient against the needs of modern requirements.

- These factors are exaggerated in urban areas where,

a) proximity to the end customer is increasingly critical for the efficiency of the supply chain.

b) suitable land supply is typically falling.

Proximity to customers and business partners is becoming the key success criterion for efficient and robust value and supply chains, and this is evident globally. Whilst occupiers might seek to pay less to reflect the economic conditions, they will pay more for operationally efficient buildings, taking up less space, but paying higher rents per sq metre.

Rents for modern urban industrial and logistics buildings are set to grow strongly.

This will be the case for larger format Big Box logistics which will continue its growth as occupiers pursue efficiency gains seeking optimal modern space.

Rents for modern urban industrial and logistics buildings are set to grow strongly, particularly for those units with proximity to the major urban areas.

Investors could seek to invest in modern and income-producing assets or take the opportunity to create best-in-class, ESG approved, modern industrial and logistics space. Connecting the fundamentals of need for urban facilities and the shortage of available land, suggests the opportunity for more intensive use of suitable sites and these commanding higher rent and capital values.

Multi-level logistics, as we see in Asia and the US, will also gain importance in the fastest-growing European metros, as London, Paris and Hamburg already show. That intensification of site use is also likely to be a characteristic we see in 2024 and beyond.

The corollary of this is increased risks for outdated buildings in poorer locations, which could have their performance boxed in. For 2024 and beyond, investors should be looking for strong rental growth from modern and particularly urban industrial and logistics buildings.

Figure 7: Urban industrial rental growth outpaces the market – (beginning 2010 = 100)

Sources: MSCI (January 2023)

1 CBRE, 2020

EUROPEAN LOGISTICS BY NUMBERS

50%

50% of the overall container traffic in Europe is concentrated in/around the Netherlands.

The main reasons for this spectacular success are:

- centrally located region in a borderless Europe, i.e. goods may be shipped swiftly from or via Netherlands without any restrictions all around the continent

- top quality of handling services and flexible custom clearance

- unparalleled multimodal infrastructure – transforming the whole country into one major distribution hub for Europe

389

There are 389 inland barge ports throughout the Netherlands, connected to a network of 44,000 kilometres of waterways, which makes them a sustainable and efficient way to transport large volumes of cargo. Unsurprisingly, the Netherlands has by far the highest concentration of the logistics space per capita in Europe.

21%

This is the part of GDP contributed by manufacturing sector in the Czech Republic – making this country of 10 million inhabitants – a very attractive place in Europe.

Production, manufacturing and other logistic services are the key drivers behind the demand for industrial and logistics space in the Czech Republic, which has one of the highest concentrations of logistics space per capita in Europe.

Reshoring, nearshoring, ESG pressure, and ambitious plans to make Europe a strong production place again are creating excellent prospects for new demand for modern industrial and logistics facilities.

50%

The manufacturing sector in Denmark has expanded by 50% from 2010-2020 – the highest rate in Europe. A very spectacular result for the country having one of the highest labour costs in Europe. Obviously, Novo Nordisk, global pharma giant is one of the most prominent examples of Danish success. Multiple examples of industrial “reshoring” are fuelling demand for industrial space in this country.

Sources: PortEconomics (May 2023), World Bank (2022), Eurostat (November 2023)

ARTUR MOKRZYCKI

Head of Capital Markets Europe, Panattoni