As part of Savills Investment Management’s ambitions to become a restorative business, we are developing a Natural Capital strategy.

If any reminder were needed, the summer wildfires in Europe and the flash flooding worldwide has again brought the climate crisis into sharper focus. At the same time, Russia’s 2022 invasion of Ukraine has increased awareness of food and energy security.

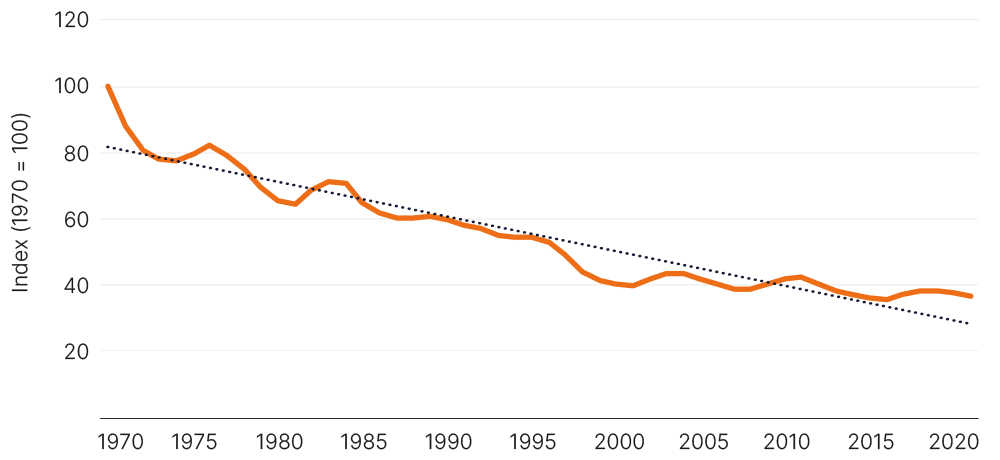

Rising average temperatures are also causing, and are partially the result of, biodiversity loss. The UK’s green and pleasant land is one of the most nature-depleted in the world. Since 1970 the UK has lost over 60% of its priority species abundance, with many remaining under threat of extinction. Carbon and biodiversity have until recently been considered separately (illustrated for example by the separate United Nations global Conference of the Parties on each) and yet they are fundamentally interconnected.

Natural Capital is the stock of soil, air, water and living things, from which ecosystem services flow to the benefit of society. Those ecosystem services include food provisioning, renewable energy, carbon sequestration, flood prevention, water and air purification, pollination, health and wellbeing. These services have largely been taken for granted and accordingly have not been valued or costed in decision making. As the late Herman Daly said: “The economy is a wholly owned subsidiary of the environment, not the reverse”. The word “capital” reminds us that nature is an asset which has a value that can be enhanced or destroyed. Nature is invaluable given our reliance on it and its life supporting ecosystems.

Biodiversity enables those ecosystems to regulate the climate and mitigate the negative effects of climate change itself. The reverse is also true, for when biodiversity is lost or depleted, the ability for ecosystems to function is lost, which creates a negative feedback loop. We are very close to that state.

Savills IM’s Natural Capital strategy seeks to tackle and mitigate these related threats of climate change and biodiversity loss through investment in land and nature-based solutions.

Nature based solutions remove carbon dioxide from the atmosphere and reverse biodiversity loss at the same time.

Nature based solutions remove carbon dioxide from the atmosphere and reverse biodiversity loss at the same time. Working with specialist teams from our sister company Savills UK, the strategy seeks to create, enhance and deliver ecosystem services and nature-based solutions by investing in nature through two approaches; land management change and land use change. The former will be the application of regenerative farming techniques to restore and build resilience in our soils and farming systems. The latter to create and restore habitats which will sequester carbon dioxide and enhance biodiversity, amongst other things. Through these changes in land management and land use we will shift from an extractive to a restorative state which, at a more general level, is central to our ability to secure a future for generations to come.

These approaches will enable us to reduce greenhouse gas emissions, sequester carbon dioxide and lock up carbon and in turn, create high integrity carbon units, bundled with multiple co-benefits including biodiversity enhancement. These voluntary verified carbon units will be available to investors to either inset to meet net zero ambitions or to sell. Biodiversity credits will also be created and sold to landowners and developers to meet their mandatory Biodiversity Net Gain requirements arising from new development.

Importantly, these credits will have a financial value that is unlikely to be correlated with the wider economy.

Such is the scale of the climate challenge we have created a Natural Capital team that pursues our ambition to be a restorative business, and this will be a focus for 2024 and beyond.

Figure 8: Change in abundance of UK priority species

Source: State of Nature Partnership (2023), UK State of Nature Report, C4a. “Status of UK priority species – Relative abundance”, 25th May 2023.

JUST SIX MORE HARVESTS UNTIL NET-ZERO DEADLINE

Awareness of the poor state of nature and extraordinary weather events both continue to increase, but as the low-hanging fruit has been taken, the costs of a net zero, nature positive transition are starting to rise. This is awakening political tension: as consumers struggle with the cost-of-living crisis, short-term pressures win over long-term investments.

This has been problematic for some natural capital project developers, where investment theses have been challenged by a focus on the integrity of offsets. Debates have raged on whether it is fair for developers to pay for nutrient neutrality, or whether avoided emissions credits are truly locking up carbon for good.

How should investors respond? I would argue it is with more urgency, not less. Enhanced disclosure mechanisms such as The Taskforce on Climate-Related Financial Disclosures (TCFD) and The Taskforce on Nature-Related Financial Disclosures (TNFD) are becoming mainstream, with influence cutting through supply chains. Insurance risk makes the case for nature-based solutions self-evident. Considering there are only six harvests left until the 2030 target that many corporates have set to reach net zero, the need to influence land management change is both important and urgent.

With a UK general election looming, 2024 might be the year where political lines are drawn in the battle to address climate change and reverse nature loss, but demand for investible nature-based projects is not abating anytime soon.

EMILY NORTON

Emily Norton is Research consultant to Savills Rural, a farmer and an independent natural capital advisor.