Real estate analysts spend much time considering macro variables and implications for tenant demand while the supply side is often overlooked as it is harder to quantify.

As Star Trek’s Spock might have said “Space is the final frontier for real estate. Let’s boldly go to explore that logic and the strategic importance of supply, operational intensity and profitability of that space.”

Operational efficiency is critical to the prospects for any business. Yet real estate investors pay insufficient attention to technology and its impact on improving the productivity of commercial space. In effect, technology is an invisible supply dynamic that improves space utilisation and marginal space requirements. Understanding the risks around this, and sectoral differences, is critical for strategic real estate investment decisions.

A measure of retail supply in square metres would not have guided prospective investment performance over the last decade. A marginal erosion of store profitability has a marked impact on rent affordability. Understanding the diversion of sales from changes in shopping habits was critical to understanding the shifts in consumption and tenant demand which saw retailers and service providers trim their store networks and rents and values adjust markedly.

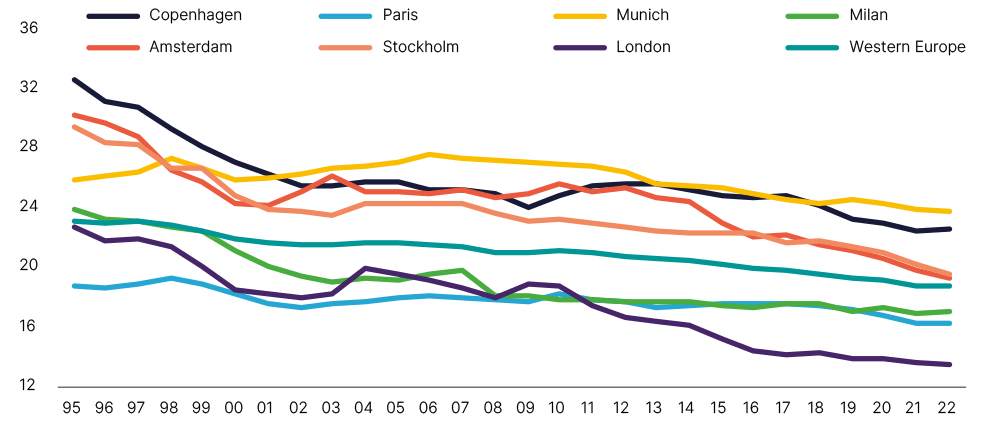

Employee density matters for offices. Technology has long enabled firms to improve the productivity of the space they occupy. Although overall office demand in Europe has increased over the past 30 years, this has been driven by demographics and population growth. In contrast, many markets have seen the amount of occupied space per employee fall over many years (see Figure 3). This is particularly the case for new supply additions designed around high density and hybrid occupation. Analysts and investors often fail to realise that greater office density implies new completions have a greater impact on supply as it can accommodate more staff, and this exaggerates supply risks. This mattered less in the past. But as future office employment growth slows (at least in Europe), occupier use will matter more. Risks in offices in general have risen.

The logistics sector is adjusting too. As a low margin industry reliant upon the speed of goods moved, occupiers will seek to improve the efficiency of the space they use. For example, Ocado (UK) announced the closure of a ‘first generation’ fulfilment centre as productivity gains from new space are higher by one-third 1. Similar to the office sector, new logistics completions should be assessed against the operational efficiency of the space delivered, not just the volume. Logic suggests occupiers could pay higher rent for more efficient space, and consequently less for inefficient space.

Living should be seen from a different angle as the impact of technology is less detrimental to the prospects of the sector. The basic needs of residents have a minimum threshold; beds and baths need to be of a certain size and in addition, residents typically want more as they get wealthier and older, often not downsizing as they reach retirement and beyond. The economics are different.

As investors look at their allocations and assets, the importance of technology in improving the productivity of space that firms demand shouldn’t be overlooked. It doesn’t mean that commercial real estate is necessarily worse than residential. Rather, investors should be on the right side of taking advantage of space efficiency. The most productive, most suitable space will thrive. Meanwhile, residential appears unchallenged in this regard and has materially lower risk to the landlord.

To focus on demand without supply efficiency fundamentals is simply illogical and this is why space is the new frontier. At a sector level living is well supported, go long in living to prosper.

Figure 3: Implied occupied floorspace per worker (sqm)

Sources: PMA, Savills IM (16 Mar. 2023)

“FLUID CONCEPTS AND CREATIVE ANALOGIES”; EXPLORING LOGISTICS SUPPLY EFFICIENCY

The logistics sector is appealing for the strength and length of the leases that can be secured by property investors. Occupiers want the most operationally efficient space and will sign long leases to secure it.

However, the value of the investment could be impacted by the changes that force logistics demand into the most efficient space, raising risks of obsolescence as the market and its requirements evolve. We consider the significant changes of the recent past to provide some context as to what occupiers need for logistics space in coming years.

Taking the example of Amazon; logistics and what is demanded from its buildings is a fluid concept.

1995 (US) delivered their first book order ‘Fluid Concepts and Creative Analogies’ by Douglas Hofstader.

1998 (UK) delivered their first order and opened first fulfilment centre near Milton Keynes.

2009 (US) commences same-day delivery in 7 US cities.

2012 Amazon buys Kiva robotics.

2015 (UK) commences same-day delivery.

2016 (UK) Kiva robots installed at Dunstable and Dunfermline fulfilment centres.

2023 (UK) announces closures of fulfilment centres in Gourock, Doncaster and Hemel Hempstead, that opened in 2004, 2010 and 2014, respectively.

2023 (US) reports that in year to July it had delivered four times the “same day / next day” deliveries as it had achieved by the same period to July 2019, and a plan to double the number of same-day sites over the next two years.

2023 announces, use of delivery drones, that it has over 750,000 robots in use, and exploring robotics to undertake agile activities prior only undertaken by employees.

What next? We recognise robotics and AI have implications for further autonomy gains and the nature of locations required, and that change could be considerable given the investment in greater operational efficiency.

We reach two recommendations, i) urban proximity for same day delivery is key and ii) examine the releasing potential of the space, its ‘second life’. And for a creative analogy, we are the urban spacemen; have in mind the Bonzo Dog Doo-Dah Band’s 1968 UK music chart success ‘I’m the Urban Spaceman’.

ANDREW ALLEN

Global Head of Research, Product Strategy & Development