The last three years have been characterised by heightened global uncertainty because of the rapid rise in inflation and subsequent increase in central bank policy rates.

Unsurprisingly, investors have been cautious to deploy capital as sellers struggle to acknowledge downwards pressure on prices. Buyers, meanwhile, expect to pay less given the deteriorating macro environment and the uncertain outlook.

In recent months, inflation has decelerated and visibility around the timing of peak interest rates has improved. Prospective investors are asking whether the time is right to deploy capital into real assets and the optimal route; debt, equity (direct real estate) or both.

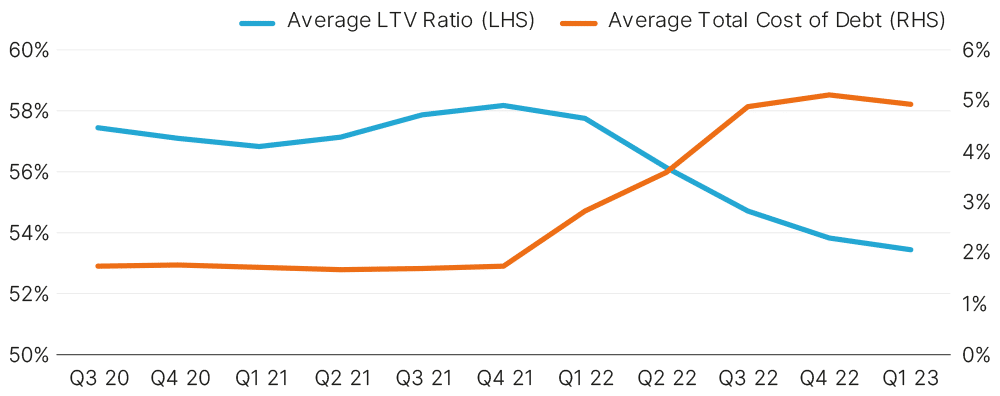

Real estate debt markets are experiencing several supportive trends which in our view creates a compelling opportunity today. Declining availability of debt financing, real estate yield rerating, and rising interest rates have created favourable return conditions. Furthermore, as interest rates have increased, new day-one loan LTVs have declined (Figure 2) which will have put pressure on the funding gap that borrowers need to fill via equity injection or more debt. Senior loans, which typically represent 50-55% of a property value, are structured to provide stable cash flows to investors. Attractive features include downside protection, provided by the first mortgage structure (these investors get paid first in times of distress), large equity cushion, strong covenants and cash traps that can be used to deleverage the loan.

Returns from senior loans depend on asset specifics, but IRRs are circa 6-7% over a five-year loan maturity period. This return will be attractive given the strong downside protection of the large equity cushion; property prices would need to drop by circa 50% to erode all the equity and to impact the senior debt. This would be an unprecedented deterioration of capital values.

Debt markets are experiencing several supportive trends which in our view creates a compelling opportunity today.

Whole loans, like senior loans, are joint first in line for any payouts on recovery, but offer higher LTVs, increasing risk but also potentially higher returns. For example, compare the incremental return for the extra leverage provided by a 65% LTV whole loan priced at base rate plus 3.75% to a 50% LTV senior loan priced at base rate plus 2.5%.

The return on the extra slice of leverage in the whole loan (50%-65%) is more than 11%. The high incremental return reflects the fundamentally different cost of capital that the predominance of providers of whole loans have versus banks who dominate the senior market.

The risk-adjusted returns from senior real estate lending look compelling.

Against the backdrop of market volatility and future uncertainty, investors will prioritise investment strategies with stable and secured incomes. Investments with strong downside protection in the form of first mortgage and substantial equity cushion combined with contracted coupon payments provide these fundamental characteristics. Investors seeking more upside will either need to seek exposure in higher LTV debt strategies or selected real estate equity strategies, both requiring higher conviction and a move up the risk curve.

Higher returning debt strategies will naturally forgo some of the protections provided by senior and whole loan strategies in exchange for the higher potential returns required by certain investors. It is worth noting that there has always been a considerable range in returns within sectors. This is relevant when lenders are considering equity cushions. An illustration using European offices (MSCI data), shows that the average historical total return spread in offices has varied significantly – with an average annual dispersion between the 5th and 95th percentile of some 35% over the last 20 years. Lenders should be considering whether their equity cushions need to be checked for potentially unprecedented capital movements. In times of heightened cyclical market uncertainties, senior real estate lending protected by the cushion of high equity represents an appealing investment approach for institutional investors.

Figure 2: Average LTVs and total cost of debt

Source: CBRE (June 2023)

OPPORTUNITIES IN REAL ESTATE DEBT, AN ASIAN PERSPECTIVE

I am commonly asked if timing is right for institutional clients to invest in real estate private credit in APAC and where might those opportunities be?

We should recall the sector is less mature than the US and Europe relative to the size of underlying asset markets, and the region is remarkably diverse whether considered politically, economically or by legal system.

The most advanced market for non-bank lenders in APAC is Australia, reflecting the deep and liquid institutional real estate investment market.

Within Australia, high quality opportunities exist where traditional banks are doing less, whether in unloved sectors like retail and hospitality (applying conservative first-mortgage leverage) or Living and industrial (meeting needs for higher leverage based on asset market fundamentals). In both cases, the ability for institutional investors to access capital-protected returns from the increasingly professional non-bank market are compelling.

In terms of opportunities beyond Australia.

- Hong Kong’s private credit market is relatively attractive and currently dominated by real estate family offices and some US distressed and special situation funds.

- In Japan and Singapore, the highly liquid bank market continues to be dominant at competitive pricing, leaving little room for alternative lenders.

- In terms of the next frontier, many managers have identified India but “how to access” is the most frequent refrain? And other countries more frontier still for now.

Within all these individual country dynamics, the conversation I frequently hear is how to build a pan-regional real estate private credit business. The opportunity is there for experienced firms from Europe and the US to deliver a global platform for clients (and vice versa for outbound Asia lenders).

With capital, opportunity, and our platform across the region, we are well placed to be active in APAC real estate credit in 2024, but its G’day Australia for starters.

STEVE WILLINGHAM

Head of Asia DRC Savills Investment Management