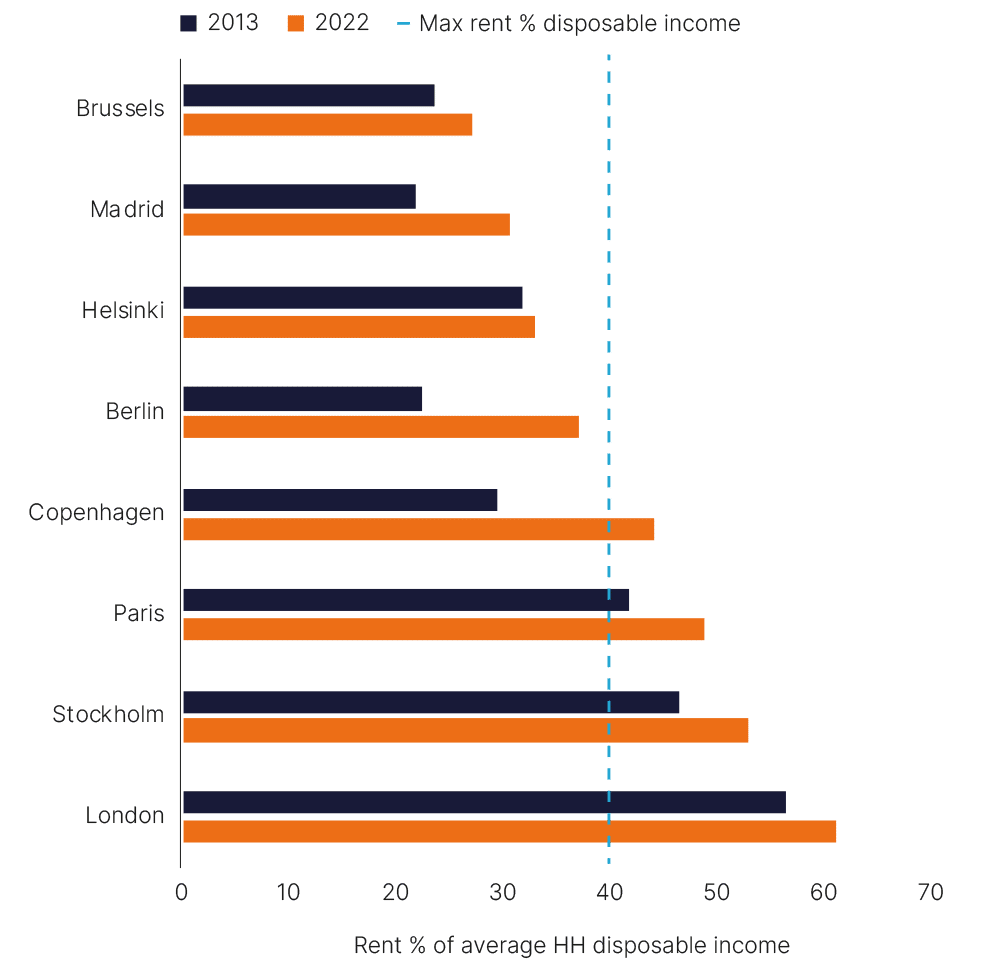

Residential rent-to-income ratios have risen across all European markets we monitor in the past decade. Figure 6, on the following page, illustrates the point. Demand continues to outstrip supply, and consequently the average household faces a marked deterioration in affordability and with limited alternative housing options. Rent affordability is the issue for residents, policymakers and investors into 2024 and beyond.

There is no universal definition of what constitutes rent affordability. The OECD defines people spending more than 40% of disposable income on housing as overburdened. Whilst affordability is a general measure for the rent to be within the means of the resident, more specifically we define affordability such that rent does not consume more than 30-40% of the average household disposable income band,

€35-70k p.a.

The OECD defines people spending more than 40% of disposable income on housing as overburdened.

Why is affordability getting worse?

Supply has, and is not, keeping pace with demand and house prices and rents have grown ahead of wage growth.

In the past year, to the end of Q3 2023, apartment rent levels rose on average by 8.2% 1 across Europe (ex-UK) and in the UK on average by 10% 2. This is directing more household income to rent, and together with rising utility and food costs, is putting many households into financial stress.

What will improve affordability?

The answer lies in a major programme of development, but the short-term answer is that no quick fix exists, from either the public or private sectors. Consequently, the prospect of policy interventions on rents through controls is rising.

Investors should be mindful of the affordability thresholds of their residents and the risks of policy responses as the affordability crisis deepens 3.

What solutions can institutional investors deliver?

Long term, institutional investors can be part of the delivery of new supply. Short term they should take steps to reduce reliance on extreme, top-line, market rental growth. Focusing on affordability and minimising cost leakage, through regular scrutiny of opex, could help landlords manage a return to more modest, but still attractive, rental growth. Such steps might include:

- Regular maintenance checks to address issues when they arise;

- Monitoring resident satisfaction and requirements;

- Reduce void time and resident turnover.

Income leakage, the difference between an investors’ gross rental income and that income once costs have been deducted, varies by country and living segment. In Denmark, total net operating costs as a percentage of gross income averaged c.34% over the past five years compared with c.22% in Austria 4. There is a clear opportunity to use best in class techniques from one country or segment to another.

Ensuring adequate investment in buildings will help retain residents, reducing the need for landlords to lift rents significantly to claw back lost income. Capital expenditure is under pressure and determining what is necessary capex has come to the fore.

What can the landlord do?

Prioritising the residents and ensuring their satisfaction around affordability and quality of their rental home means they will likely stay longer, the community benefits will improve, and, for the investor, it simply makes sense.

Prioritising residents and their satisfaction… means they will likely stay longer, benefitting the community and the investor.

Figure 6: Comparison of average two-bedroom rent-to-average household disposable income by city

Sources:

Figure 6: Savills IM, Oxford Economics, Eurostat, data as at June 2023, nb: all data used are nominal and averages and do not account for tax and other charges. Rent is reflective of a good quality two-bedroom apartment not older than 10 years

1 HousingAnyWhere, data as at October 2023

2 Zoopla, data as at September 2023

3 Savills IM, “Rent Regulation – can there be a fair and balanced approach?”, May 2023

4 MSCI, data as at December 2022, *includes cost of voids