Real Estate investors have long been able to explore or exploit that every property is different with certain investors having an information advantage.

But in this information age the landscape has shifted, where data access is more democratic, where new data supersedes the old, and where analytical techniques are emerging at speed. The implications are of considerable relevance for real estate investors and we are certain that the question of preparedness for the ongoing disruption is key for 2024 and beyond.

I write this article having just read of AI augmented embryo scanning techniques achieving a 30% greater success in IVF, and heard Barbie Girl authentically reimagined by Johnny Cash. The frontier of what is possible through digital data, analytics and machine learning is accelerating faster than our imaginations are prepared for.

So, what should we do and how do we best ‘Walk the Line’ in real estate? The issue splits into two groups, those factors within our control and those that lie outside.

The house comes first, control of our own data

Real estate produces an array of proprietary data for the owner, it is essential that this is the focus. In short, extracting and managing data from within our existing investments.

Whilst managers will have systems to log factors including lease activity, income, value and financial performance measurement, the progression of data sources, often ESG and occupational measurement techniques, is a new area of focus. Fundamentally, the quality of assets is driven by a wider array of factors, frequently related to ESG and the costs of running buildings and the risks of obsolescence need measuring.

Data is the fuel to our business: Having a ‘golden truth’ of a widening set of data is a key focus for our business now. Data stored systematically and dynamically will be the competitive advantage. This will lead to significant operational gains of benefit to the investor, and leave those without such systems, trailing.

Data stored systematically and dynamically will be the competitive advantage.

Embrace the future and the expanding frontier, but should this be in-house?

Whilst machine learning captures the imagination and risks potentially blind alleys and false assertions, there is growing evidence that AI data techniques can make a positive difference to businesses. This is increasingly a focus for us in 2024.

Outside of real estate, the Boston Consulting Group has recently studied its own consultants, assessing 18 standard tasks and the productivity of using Chat GPT; there are notable conclusions.

Consultants using it completed 12% more tasks, completed 25% of tasks more quickly and with a quality level some 40% higher than those that did not use it. Furthermore, the study concluded that the use of AI was able to raise the quality of less skilled consultants; the tool is a great leveller as data and its analytics become more democratic. The historic analogy of skilled miners being outmoded by steam driven mining machines is helpful; what we have taken for granted as a skill or information advantage will be eroded by the new data techniques.

But what of our focus in real estate and AI? The BCG study focused on known and established questions and this is key. For us this will be initially around aggregation and interrogation of known and clean data. This could facilitate report writing, formulaically assess leases, site selection, create more dynamic pricing models for our occupiers, or swifter reaction in filtering investment opportunities. More detailed interrogation of dispersed, external data sets will lie outside our immediate internal focus. We see it as risky and costly bringing all data aggregation and interrogation techniques in house for now, as we expect a rapid emergence of specialist data houses that we can work alongside on a consultancy basis.

2024 will be a major turning point in the adoption of data, data techniques will level the playing field, but also raise the standard to which everyone

is working.

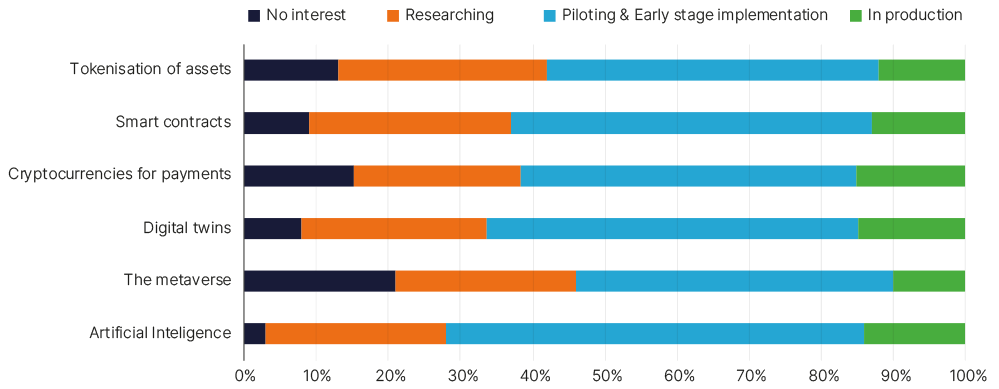

Figure 5: Real estate company’s current level of engagement on emerging technologies

Source: Deloitte, 2024 commercial real estate Outlook, Savills IM (31 October 2023)

IT’S ALL ABOUT THE DATA

The real estate industry has talked a lot about the use of data, technology, and now AI. Over the years, however, the industry has moved from one hyped-up concept to another (LEED, big data, blockchain, crypto, self-driving cars, digital twins, AR/VR, 3D-printing, the Metaverse, ChatGPT), all promising to “transform” the world of real estate and all seeming to fall short of those promises.

AI is different, though. AI and machine learning (ML) can be extremely powerful, effective, and valuable tools far beyond what I think any of us can really imagine. But you first need to dismiss the hype and the belief that you can just throw random data at “an AI” and receive miraculous answers to any problem you want to solve. AI and ML are mathematics, not magic. They are based on the process of developing mathematical models that represent some activity in the real world, collecting the data relevant to that activity, and using technical approaches to find patterns and relationships in the data that allow us to make better, faster, and more accurate predictions about the future.

AI is different because it’s not an outcome, it’s a foundation. It’s a foundation to make better sense of the fundamentals about how the world works. It’s a tool that allows us to develop insights and understanding based on exponentially more information than the human brain is capable of processing by itself. Those insights can lead to significantly improved decision-making and strategic capabilities.

I’ll leave you with a few questions to think about. Are you where you need to be in using data and analytics in your company? If not, are you doing what you need to do to get there? If not, why not? Do you even know what needs to be done to get there? Has your current strategy worked and is it working? The answers to these questions are usually “no.”

There is no shortcut to developing and using AI effectively. It’s going to take significant resources and dedication, far beyond what’s been seen so far in the real estate industry. We need to stop chasing outcomes, stop worrying about the FOMO and what your competitors are doing, and start taking a fundamental approach to developing sophisticated data collection and analytical capabilities for the AI systems to analyse.

JOSH PANKNIN

Josh Panknin is Director of Real Estate AI Research & Innovation at Columbia University, New York.